Business Insurance in and around St George

Get your St George business covered, right here!

Almost 100 years of helping small businesses

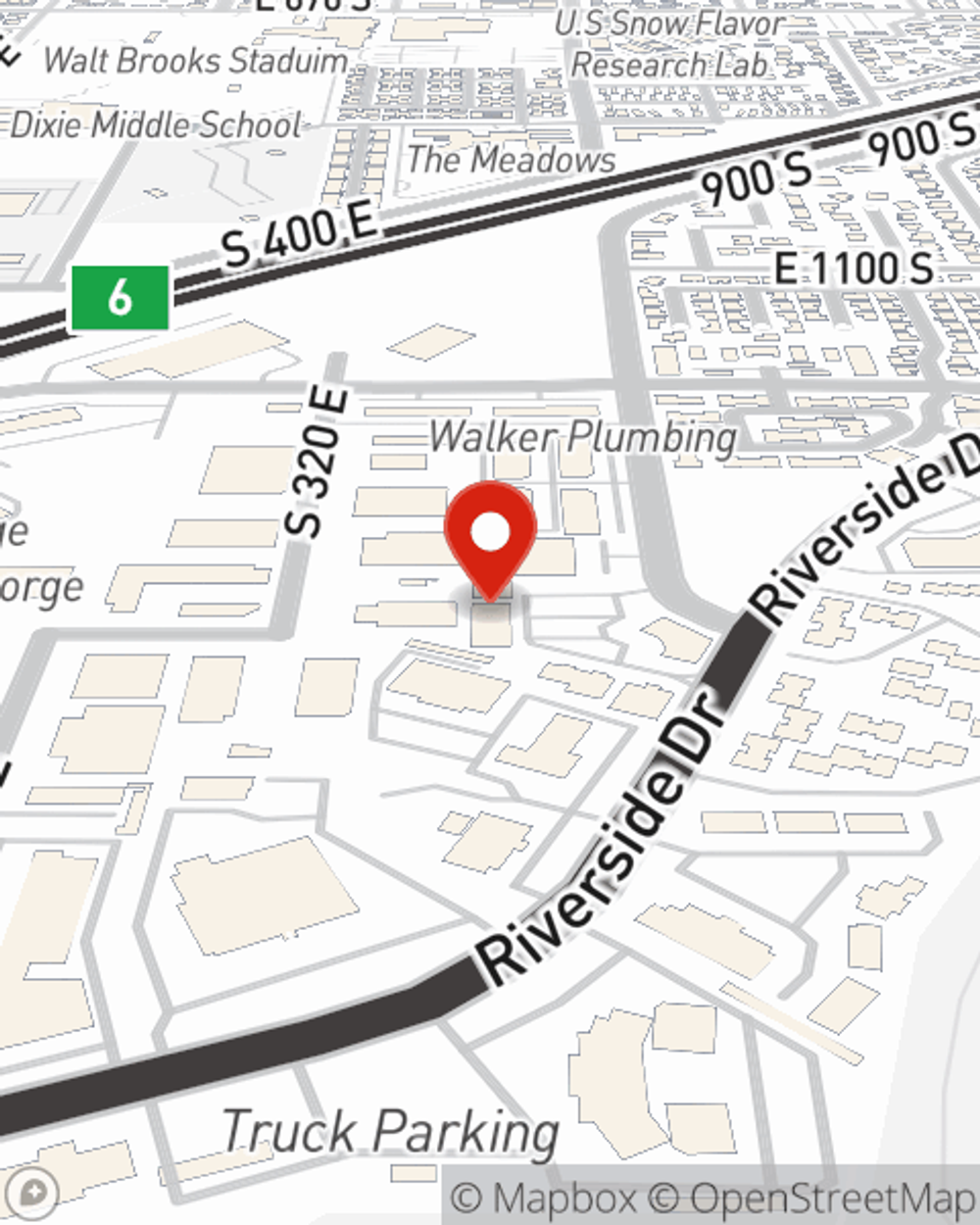

- St. George

- Washington City

- Hurricane

- Leeds

- Santa Clara

- Dammeron Valley

- Washington County

- Iron County

- Mesquite

- Las Vegas

- Utah

- Nevada

- Arizona

- Salt Lake City

- Provo

- Ogden

- Cedar City

- Kanab

- Colorado City

- Fredonia

- Beaver Dam

State Farm Understands Small Businesses.

Sometimes the unanticipated does occur. It's always better to be prepared for the unfortunate mishap, like a customer hurting themselves on your business's property.

Get your St George business covered, right here!

Almost 100 years of helping small businesses

Surprisingly Great Insurance

Our business plans rarely account for every worst-case scenario. Since even your most detailed plans can't predict consumer demand or product availability. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for the unexpected with a State Farm small business policy. Business insurance is necessary for many reasons. It protects your future with coverage like business continuity plans and errors and omissions liability. Fantastic coverage like this is why St George business owners choose State Farm insurance. State Farm agent Seth Porter can help design a policy for the level of coverage you have in mind. If troubles find you, Seth Porter can be there to help you file your claim and help your business life go right again.

So, take the responsible next step for your business and visit with State Farm agent Seth Porter to discover your small business insurance options!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Seth Porter

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.